|

There is something troubling about a guest corporation from the People's Republic of China litigating our local government in order to compel them to use our native natural resources to benefit Beijing at the expense of the very local citizens who collectively own the resources.

Beijing's Bitmain and their partner Allrise Capital appear to be preparing to sue our PUD over control of the Box Canyon Dam power. As we have previously reported, Bitmain/Allrise have repeatedly threatened our PUD in the past. See Beijing's Bitmain's and Allrise Capital's local executives repeatedly threatened our PUD for refusing to subsidize their Bitcoin mining public records show - PROTECT PEND OREILLE Now Bitmain/Allrise's attorney, Mr. Andrew Moratzka from the law firm Stoel Rives, LLP, recently requested hundreds of pages of PUD documents relating to our PUD's beneficial contract with the Clark County PUD in Vancouver, WA, for the entire future output of the PUD-owned and operated Box Canyon Dam through 2041. Large public records requests by law firms are typically preparatory to a lawsuit. Bitmain/Allrise are after the power produced by the Box Canyon Dam because, until this month, it has been much less expensive than the market price of electricity that Bitmain/Allrise have been paying since they started full-scale bitcoin mining operations last September. For a more detailed explanation of how power costs impact their revenue potential, see POC Cryptonomics - PROTECT PEND OREILLE Contrary to misinformation campaigns by Bitmain/Allrise (See: PUD Documents Show Allrise/Bitmain Misleading Public about Box Canyon Deal - PROTECT PEND OREILLE), our PUD kept the bitcoin company informed on their efforts to remarket the power from the Box Canyon Dam after the PNC papermill bankruptcy left our PUD and the residents of Pend Oreille County with $22 million in unpaid debts. Our PUD repeatedly invited Bitmain/Allrise to bid for a long-term contract for the power, but Allrise's CEO confessed that they did not have the money to pay for a long-term contract. Unable to pay for the Dam's output, Bitmain/Allrise have sought to force our PUD to cancel the Clark deal-- something that would cost the residents of POC millions of dollars each year. See: What's at stake? Crypto plans in power negotiations would cost Citizens of POC millions, throttle local economy - PROTECT PEND OREILLE Last August, Allrise announced a highly questionable plan to restart the former PNC papermill-- contingent, of course, on our PUD agreeing to provide them with the power from Box Canyon at a substation discount to what Clark PUD agreed to pay. In February, Bitmain/Allrise retained a west-side lobbyist in an attempt to get the state legislature to compel our PUD to cancel the Clark deal and sell them the power at a discount. Now, it appears they are preparing a lawsuit. Although the power from Box Canyon did help power the papermill for many years, it was never sufficient to power the mill (or the later bitcoin mining facility) without additional market power. However, it is enough power to significantly subsidize the Bejing's bitcoin mining at the cost of millions of dollars each year that would have to be paid for by POC residents.

0 Comments

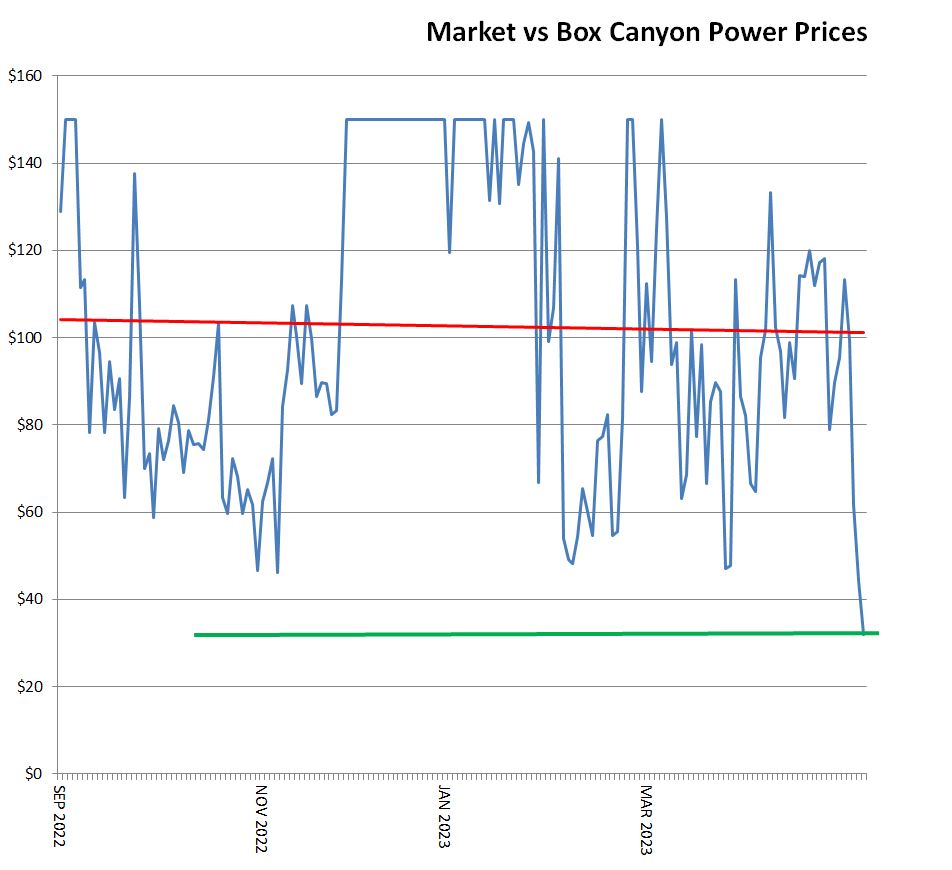

Bitmain/Allrise-requested BPA study due this week appears designed to pick a fight with PUD5/23/2023  Over the last few weeks, crypto executives have repeatedly stated that they are waiting on the results of Bonneville Power Administration (BPA) study that they hope will allow them to begin planning on restarting the former Ponderay Newsprint Company paper mill/ current bitcoin mining facility in Usk, WA. They study, which was requested by Beijing's Bitmain and its partner Allrise Capital last September and is expected to be completed this week, appears designed to provoke a public fight with our citizen-owned PUD over whether the electricity from the Box Canyon Dam will be used to benefit residents of Pend Oreille County or to subsidize Beijing's crypto revenue. This report will review the history and context of the requested BPA study, examine what questions Bitmain/Allrise asked the BPA to study, and consider the implications of potential findings. History and Context In early 2022, Bitmain and Allrise announced that they were planning on turning the former PNC paper mill in Usk, WA into a one of the largest bitcoin mining facilities in the world with a power capacity of 600 Megawatts. At that time they were planning on getting that massive amount of electricity through a large, international power broker called Brookfield Renewable. In fact, in April 2022 they told the PUD commissioners and staff in a public meeting that they would not require any electricity from our PUD for their facility. However, less than a month later, Brookfield Renewable walked away from negotiations after conducting a due-diligence "Know Your Customer" review of the Bitmain/Allrise. Around the same time, the BPA completed a power study previously requested by Bitimain/Allrise asking how much it would cost to expand the Usk facility to the planned 600 MW electricity load. The answer was not good for the crypto scheme- it would cost over $100 million and take 4-7 years. Desperate for new source of electricity, Bitmain/Allrise immediately began negotiations with our PUD for 100MW of power. They signed a 13-mongth contract with our PUD in mid-August 2022. During the three months of negotiations, Bitmain/Allrise did not ask for any power for a papermill restart. However, less than two weeks after signing their new power contract with our PUD, Bitmain/Allrise suddenly announced that they wanted to restart the papermill as early as November 2022-- despite, as several former mill employees had observed, a potential restart requiring a year's worth of maintenance work and millions of dollars in new investment. A year before, Bitmain/Allrise executives had told the BPA not to even consider studying supplying power for a paper mill. See: Public Records Show Allrise Told PUD/BPA Not to Study Power for Paper Mill Shortly After Mill Purchase - PROTECT PEND OREILLE So what changed? The answer is: power prices. Bitmain/Allrise's announcement of their new-found desire to reopen the paper mill was contingent on the PUD providing them with a new, lower-cost power contract. At the time that Allrise and Bitmain inked their joint venture agreement in the fall of 2021, they were expecting to be able to power their energy-hungry bitcoin computers for around 3 cents per kilowatt hour. By they time they were ready for full-scale operations in September 2022, however, power prices had skyrocketed. Power from Box Canyon Dam, which costs around 5 cents per kilowatt hour to produce, would allow them to get electricity cheaper than current market prices. See the chart below comparing market prices with the cost of power from Box Canyon Dam. The blue line is the average market price of power, the red line is the cost of Box power. See: POC Cryptonomics - PROTECT PEND OREILLE The problem for Bitmain/Allrise was that the getting control of Box Canyon would mean that the residents of Pend Oreille County would need to subside their crypto mining by giving up millions of dollars of revenue each year from the Dam and accepting the extremely high financial risks involved in subsidizing one of the highest-risk industries in history. They could use the claim of restarting the paper mill, something almost universally supported in the county, as a red herring to trick the county's residents and pressure our PUD into subsidizing Beijing's bitcoin production. See: Facts on the Ground show Allrise couldn't open the paper mill within five years if they wanted to (and they probably don't) at PROTECT PEND OREILLE - Home So, last September, they asked the BPA to study the feasibility of using the Box Canyon Dam to power their facility. What Bitmain/Allrise asked What does Bitmain/Allrise want? As the customers paying for the study (it cost them around $30k), Bitmain/Allrise get to ask the questions they want the BPA to answer. The questions they asked had already been answered or what blatantly infeasible. It appears that the intent of the questions was to hope that the BPA would respond in a way that would support Bitmain/Allrise's pressure campaign on our PUD over Box Canyon Dam. The study asks: 1) Can the Box Canyon Dam be used to power the facility directly by using an existing 115kV power line connecting the Dam to the BPA's Bell Substation in Mead, WA? (The Bell Substation connects the Dam to the regional grid) 2) Can the BPA's Albeni Falls Dam be used to power the facility directly using the same power line? 3) Can Bitmain/Allirse purchase electricity on a day-ahead schedule instead of a month-ahead schedule? (This would allow the crypto facility to only purchase electricity when it is profitable.) To see the original document, download the attached study request below. The key point is that this would enable Bitmain/Allrise to use power either from the market or directly from the Box Canyon Dam, allowing them to use the cheapest source of power for their crypto mining business. What will BPA report? First, it is important to remember that the decisions over how to use Box Canyon is our PUD's not the BPAs. The study is just meant to examine the feasibility. The most likely outcome is that BPA will report negatively on all three questions. In a meeting between the BPA, our PUD, and Bitmain/Allrise on May 20, 2022, crypto execs asked the BPA if they had considered allowing them to use the 115kV line connection with Box to power their facility. The notes of the meeting indicated that the BPA responded that they had and that using the line and dam to support crypto mining would negatively impact the stability and reliability of the grid. The question of Albeni Falls to directly power the crypto facility is absurd. The BPA does not use it own resources to directly power businesses. The BPA has also answered the question of day-ahead power purchases several times. The BPA system is simply not set up to facilitate such short notice changes in such large power flows. But the BPA response could be ambiguous enough to serve Bitmain/Allrise's apparent purpose: to pressure our PUD to sacrifice its other 9,600 ratepayers to subsidize Beijing's profits. To better understand the potential impacts on ratepayers in Pend Oreille County see: What's at stake? Crypto plans in power negotiations would cost Citizens of POC millions, throttle local economy - PROTECT PEND OREILLE

By Molly White

Ms. White is a nationally recognized expert on crypto frequently interviewed by national news outlets. There is nothing crypto needs more right now than more people. Crypto, when it comes down to it, relies on greater fools. As assets without any intrinsic value, the way to make money from crypto is to find a greater fool who will buy your assets from you at a higher price. Some crypto projects are very open about the fact that they rely on new people constantly coming in to their ecosystem: game developer Sky Mavis admitted that the in-game economy of their once-popular blockchain game Axie Infinity was “dependent on growth and new entrants”.17 Other crypto projects have been exposed as literal Ponzi or pyramid schemes, only able to pay out those who bought in early from the income gained through a steady stream of newcomers. As crypto has begun to exhaust its existing sources of greater fools, we’ve seen new strategies to reach broader audiences. Advertisements for cryptocurrencies began appearing in the London Tube system and on the sides of buses. NFTs were plastered on billboards in Times Square. Crypto companies began renaming sports stadiums after themselves, or entering into sponsorship deals with NASCAR drivers and baseball teams. Matt Damon told viewers of Saturday Night Football that “fortune favors the brave”, and prime ad real estate at the Super Bowl showed celebrities including LeBron James, Larry David, and Kyle Lowry urging people to buy crypto. But there’s limited value in someone downloading Coinbase from the bouncing QR code at the Super Bowl, getting their free $15 in Bitcoin, and not touching it again. The holy grail for a crypto project is when they can get someone to join in their community. This exalted sense of “community” is often trotted out as an example of all the good that crypto is apparently doing. Some starry-eyed individuals talk about how the lifelong friends they’ve made along the way have made everything worthwhile, regardless of whether they’ve gained or lost money. But “community” serves darker goals, whether by design or not. As Bennett Tomlin put it, “The sense of community and the sense of belonging becomes an important part of the narrative because once you are a Bitcoin maxi, once you’re a LUNAtic, once you’re a LINK Marine, once you’re part of the XRP Army, once you’ve tied your identity in some way to one of these groups, coins, or whatever, it becomes that much harder for you to part and to remove that part of your identity.”18 Communities encourage each other to have “diamond hands” and “HODL” (a term that has since been backronymed into “hold on for dear life”) whenever prices drop, even at huge financial risk. Some lionize the “Dogecoin Millionaire”, who “diamond handed” beyond all reason, keeping his massive holdings of Dogecoin far beyond their peak value of over $2 million and still holding now that they’re worth around $325,000.19 Crypto communities ostracize people who sell off their crypto as “paper hands” and “ngmi” (“not gonna make it”). True believers in various NFT projects encourage one another to “sweep the floor” if interest wanes (buy more NFTs—specifically those listed for the lowest prices), and coiners tell one another to “buy the dip!” All of this behavior is enormously advantageous for those behind the projects, who benefit when holders keep on holding and when people buy more. Crypto projects in general depend on people believing their tokens have value, and community behaviors that reinforce this are essential. So, crypto has a problem. “Community” is a huge part of what keeps the faith alive, and crypto more than anything relies on faith. This is part of a blog that originally appeared at: https://blog.mollywhite.net/predatory-community/ Ever since Beijing's Bitmain and Allrise Capital discovered last August they could not make a profit running their bitcoin machines on regional market power, they have been trying to trick the citizens of Pend Oreille County to subsidize their exploitative crypto mining operations by claiming that, in return for county residents effectively paying millions of dollars of their power bill, they would restart the former Ponderay Newsprint Company paper mill. As we have previously reported, it is unlikely that they have either the desire or ability to restart the mill. See PROTECT PEND OREILLE - Home One of the several ways that they want to get residents of Pend Oreille County to pay for their power is by turning over the clean energy produced by our PUD's Box Canyon Dam to them (at a steep discount). This would not only cost the residents of Pend Oreille County millions of dollars each year, it would also do nothing to reduce the price of electricity for papermaking. What it would do is reduce the average price of electricity for Beijing's bitcoin mining. Let's look at why. Suppose our PUD surrendered to Beijing Bitmain's/Allrise's demands to make the power available to them. What would happen? First, our PUD would have to get out of its lucrative contracts with Shell Energy and Clark County PUD for the output of Box Canyon. The Clark County deal is worth up to $400 million over the next two decades, is extremely beneficial to the residents and businesses in the county and is such a good deal that Moody's raised our PUD's bond rating after the deal was signed last October. Because Clark County PUD is willing to pay more for the clean energy attributes of Box power than Bitmain/Allrise, this would cost our PUD millions of dollars each year in lost revenue that residents and business would have to make up for by paying higher power rates. (NOTE: Bitmain/Allrise was offered the opportunity to bid for the Dam's output, but they admitted to our PUD that they couldn't afford it.) Second, the Box Canyon dam produces an average of 50 MW of power (more when the river is high, less when it is low). That is not enough power to run either the paper mill or the Bitmain/Allrise bitcoin mining facility, let alone both of them. Although the dam previously provided some of the power required by the mill when it was operating, it rarely provided enough power to run the mill without additional power from other sources. But getting Box Canyon would do a lot to reduce Beijing's average power bills. The following chart shows the average daily market price of power in our area. The red line shows the average trend price. The green line shows the production cost of Box Canyon power. This graph clearly shows why Bitmain/Allrise are interested in Box Canyon. Ask this question to yourself: would Bitmain/Allrise use its cheapest power for a failing paper mill or its main business of feeding its bitcoin miners and increasing its crypto revenue? One of the three main reasons Bitmain/Allrise's bitcoin mine is losing money is that their power prices are much higher than they expected. The assertion that Bitmain and Allrise would want to use their already financially failing bitcoin mining to subsidize another failing business is not reasonable. See more one the Usk facility's economics here: POC Cryptonomics - PROTECT PEND OREILLE

I think we can safely say that Box Canyon power would be used to subsidize bitcoin mining, not paper making. How Beijing's Bitmain gets the overwhelming majority of the money from the Usk bitcoin facility5/11/2023 Understanding the relationship between Beijing's Bitmain and Allrise Capital can be confusing given Allrise's efforts to publicly downplay Bitmain's role and the labyrinthine corporate structure featuring a multiplicity of subordinate limited-liability corporations including Cascade Digital Mining and Merkle Standard. But here is what you need to know:

1. Bitmain is the by far the majority investor 2. Bitmain controls the bitcoin mining process and the related cash flow 3. Bitmain receives or will receive the overwhelming majority of the revenue This report will review the three main ways that Bitmain cashes in their joint bitcoin mining facility in Usk, WA. 1. Bitmain will get repayment for the 18,000 bitcoin mining computers currently installed at the Usk site. The market value of these machines when they shipped last year was $227 million dollars plus up to $63 million in shipping fees and tariffs. When you compare that to the $18 million Allrise contributed to the purchase of the facility at bankruptcy auction, it is easy to see that Allrise is the junior partner. The amount that Allrise owes Bitmain is likely less than the market value given that size of the purchase and the other ways Bitmain gets cash flow out of the deal. Merkle Standard COO Monty Stahl described their partnership as a "hundred million dollar joint venture," whcih would still put Bitmain's relative contribution that needed to be paid back at 5-6 times more than Allrise's own investment in the facility. But Allrise did not pay Bitmain up front for the machines. As one of the county's crypto insiders explained to me: "In finance you'll see partnerships formed between asset holders and management. So Bitmain is the industry leader in making block chain mining equipment so Merkle Standard went to them for the purchase. Instead of writing a check for that, businesses will form a partnership based on the return of investment, i,e. purchase of the asset with that contractual obligation being the horizon for the partnership. This way the buying company retains liquidity for other projects and needs while still acquiring the necessary funding for equipment and the selling company sees [not] only a repayment for the purchase but a rate of return in addition usually a few basis points." In other words, Allrise will need to repay Bitmain the $100-300 million back over time. But Bitcoin mining computers only last a few years at most, meaning that the bill from Bitmain will be coming due soon. 2. Bitmain gets an additional percentage of all mining revenues in the form of mining fees. Almost all bitcoin miners basically contract their machines to one of the seven main "mining pools" which actually control the bitcoin mining process remotely. Bitmain controls roughly one-third of global bitcoin mining through its mining pools. The facility in Usk represents between 2 to 3 percent of Bitmains' total mining capacity. The mining computers they build come with preinstalled software that connects them to mine for Bitmain's own pools. Bitmain controls the mining process, receives all the bitcoin, and controls all the related bitcoin transactions. Bitmain then pays the miners a relative share of their total mining revenue after keeping between 4 to 25 percent of the revenue for themselves as a "pool fee." For example, yesterday Bitmain received 300 bitcoin from its global mining empire. They would then pay Cascade Digital Mining around 6 of those bitcoin representing CDM's 2-3 percent contribution to Bitmain's total effort while keeping up to 2 bitcoin for itself as a "pool fee." See our previous report on mining pools: Bitcoin's Big Bluff: 3 companies control super majority of bitcoin transactions-- 2 of them from the PRC - PROTECT PEND OREILLE Cascade Digital Mining then uses it's six bitcoin (converted to cash) to pay the PUD for electricity and reimburse Allrise Capital for employee salaries, taxes, the purchase price of the former PNC mill, etc. 3. Bitmain gets revenue from its equity share in the joint venture company. Cascade Digital Mining is the actual joint venture company between Bitmain and Allrise. According to public documents submitted to our PUD, Allrise claims that Bitmain has one-third of the equity in Cascade Digital Mining. So Bitmain has the right to one-third of any of the remaining revenue AFTER they have been reimbursed for the cost of their mining computers and AFTER they have already received their pool fees. While Merkle Standard, which is wholly owned by Allrise Capital and manages the facility (but not the bitcoin mining process and resulting revenue), acts as the public face for the facility, it doesn't meet the Golden Rule-- he who has the gold makes the rules. Bitmain is both the overwhelming majority investor and directly controls the daily revenue generated by the facility. If that sounds like a bad deal for Allrise Capital, it probably is. See our report "Why the Usk Bitcoin Mine is a Financial Disaster for Bitmain and Allrise Capital" POC Cryptonomics - PROTECT PEND OREILLE Publicly, Merkle Standard claims it is committed to clean energy and reducing carbon emissions. Privately, not so much.

As legislation targeting environmentally harmful bitcoin mining in the state sailed through the state legislature, Bitmain/Allrise's joint venture bitcoin mining facilities remained defiant over refusing to purchase clean energy for their voracious bitcoin computers. Public records show that as the State Senate was considering HB1416, our PUD asked Bitmain/Allrise (also known by the names of the subsidiary LLCs as Merkle Standard or Cascade Digital Mining, among other names) if they wanted to reconsider their zero clean energy policy. In a letter dated March 20 from PUD Interim General Manager April Owen to Cascade Digital Mining’s Steve Wood: “Further, while the District understands that Cascade is not requesting that any of its power be supplied from specified or carbon-free resources, please let us know if your view on this changes and if you would like the District to explore options for such power.” Wood responded, “Regarding specified source or carbon free power, we need to be clear on this. … [W]e do not request the District to acquire carbon free resources outside the District’s CETA obligations, solely to serve Cascade unless such resources are in the form of Box Canyon hydro, Boundary hydro allocation or displacement relating to BPA net requirement power allocations.” In other words, Bitmain/Allrise are unwilling to pay for clean energy but are demanding that our PUD turn over the inexpensive clean energy it provides to the rest of its 9,600 industrial, commercial, and residential customers to them. Make everyone else pay more for clean energy on the market. Bitmain/Allrise's 100MW bitcoin mining facility in Usk, WA, is the largest bitcoin facility west of Texas. Unlike many other bitcoin mining facilities in other parts of the country, Washington's energy market gives Bitmain/Allrise a choice to purchase clean energy, but they refuse to pay the small additional amount (less than half a cent per kilowatt hour) for source-specified clean energy (electricity from certified clean energy sources like hydro, wind, or solar). Last month the New York Times reported that Merkle Standard emits over half a million tons of carbon dioxide a year. In reality the amount is much higher since the New York Times assumed it was using a higher proportion of renewable power, unaware that the managers of the Usk facility have refused to pay for any clean energy. According to the data provided by the NY Times, this puts Merkle Standard among the top ten carbon-emitting bitcoin facilities in the country. The Real-World Costs of the Digital Race for Bitcoin - The New York Times (nytimes.com) To put that in perspective, even using the Times underestimate, they emit the same amount of carbon dioxide as driving 1.3 BILLION miles or powering over 100,000 homes with fossil fuels for a year. Bitmain/Allrise poor environmental citizenship may have been the motivation for the State Department of Commerce asking that State Legislature to pass HB1416. According to investigative reporter Kaylee Tornay of Investigate West in an article "Washington passes climate goals for crypto and data centers" published last week in the Spokesman-Review, "Proposals in Oregon and Washington to regulate carbon emissions tied to crypto mining and data centers took opposite paths during the 2023 legislative session. "Rep. Beth Doglio, D-Olympia, who sponsored the Washington bill, wanted to close a loophole that some crypto mining operations could exploit, which allows them to buy power on the market from nonrenewable sources if the hydroelectric-powered local utility can’t satisfy their demand." Washington passes climate goals for crypto and data centers | The Spokesman-Review In testimony on House Bill 1416 to the Washington State House of Representatives Energy Committee hearing on January 30, 2023, Glenn Blackmon, energy policy manager for the Washington Office of Energy and the senior energy advisor to the state, when asked “Could you give me an example of what this bill is trying to address?” stated the Allrise/Bitmain crypto mining facility in Usk is the best example. “Under current law, they wouldn’t necessary have to use clean electricity in compliance with CETA…, yet CETA says that all of the electricity that is used by customers in Washington should be clean…” HB1416 was signed into law last week, but its provisions will not go into effect for another year and half. In the meantime, Bitmain/Allrise have signaled their defiance to environmental stewardship and the State's clean energy policy. Bitcoin advocates promise they are building an alternative democratically decentralized financial system. The reality is that bitcoin transactions are controlled by a small number of companies mostly based in the authoritarian People’s Republic of China. Bitcoin is neither decentralized nor democratic.

Let's say you own a bitcoin and were actually able to find something you could buy with a bitcoin. There are two ways you can spend your bitcoin. The first way is that you could pay a bitcoin miner to process your transaction on the bitcoin public account spreadsheet they like to call "the blockchain" to make it sound more high tech. The second way is that you could transfer your bitcoin to a centralized crypto exchange like the well-known fraudulent exchange FTX, where you could trade it for cash, and then transfer the cash to bank account and buy what you want with dollars. In the first scenario, the bitcoin miner processes the transaction. When a miner wins the guessing game competition they deceptively call "mining" or "proof of work," they also win the right to process the next batch of bitcoin transactions for which they get to charge transaction fees. But there must be hundreds or thousands of miners around the world, right? Well, yes and no. Bitcoin mining is actually controlled by a very small number of companies called "mining pools," Because the odds of winning bitcoin competitions is small and unpredictable over the short term, owners of the miner pool their computer guessing power effectively turning over control of their miners to the company running the pool. An easy way to think of it is that the mining pool company is the general contractor, and the miners are subcontractors. For example, 18,000+ specialized bitcoin mining computers at the Allrise/Bitmain facility in Usk actually mines for the Bitmain-owned Antpool. Antpool controls the mining, and in return every day it sends Cascade Digital Mining (the joint venture LLC between Allrise and Bitmain) a check for their share of the pool's total earnings for the day (minus a large fee for being a part of the pool). The important point is that the mining pool company controls the bitcoin transactions, not the individual miners. And there are a very small number of those companies. Globally over the last 24 hours, miners have won a total of 150 bitcoin mining competitions (they receive 6.25 bitcoin for each win). 140 of these 150 competitions were won by just seven companies. Three of these seven (Antpool, ViaBTC, BTC.com) are owned by Beijing's Bitmain and two others (F2Pool, Poolin) are also based in the People's Republic of China leaving only two not under the PRC control. In the second scenario, you effectively move your bitcoin off of the public spreadsheet "blockchain" and onto a private spreadsheet managed by a centralized exchange were the exchange internally processes transactions without the need for bitcoin miners (technically you give the exchange ownership of your bitcoin). Centralized exchanges are even more centralized than mining pools. Binance, the largest exchange, is nine times larger than its next largest rival, US-based Coinbase (although Coinbase has indicated it may be departing the US due to regulatory crackdown on illegal securities). Binance currently manages around $10 billion of bitcoin. Recently both the Wall Street Journal and Financial Times have published front-page stories exposing Binance's attempts to hide its deep connections with the PRC. The WSJ story "Texts From Crypto Giant Binance Reveal Plan to Elude US Authorities." According to the WSJ, Binance was largely running its US exchange from China while lying to US authorities. See Texts From Crypto Giant Binance Reveal Plan to Elude U.S. Authorities - WSJ According to the Financial Times, "Binance hid substantial links to China for several years, contradicting executives’ claims that the crypto exchange left the country after a clampdown on the industry in late 2017, according to internal company documents seen by the Financial Times. "Chief executive Changpeng Zhao and others holding senior positions repeatedly instructed Binance employees to hide the company’s Chinese presence. " See Binance hid extensive links to China for several years | Financial Times (ft.com) Control of bitcoin mining and bitcoin transactions is highly centralized, and it's centralized in the PRC. Under the PRC's national security law, all citizens and corporations are required to act as agents under the direction of the Chinese Communist Party. Bitcoin is not the future we should be looking for. Allrise Capital dumped by US Bank, scrambling to find new bank to provide risk guarantee to PUD5/4/2023 Clarification: According to recently released public documents, the reason why the PUD is requiring Bitmain/Allrise is to obtain a new letter of credit from a different bank is that US Bank's credit rating is no longer high enough. A letter from the PUD to Cascade Digital Mining explaining this is attached below. Beijing Bitmain's and Allrise Capital's bitcoin mining business in Usk, WA, took another financial blow this week as US Bank cancelled the letter or credit the bank had provided to our PUD. The letter, known as a performance guarantee, protects the citizen-owners of our PUD should Cascade Digital Mining, the LLC joint venture between Bitmain and Allrise Capital, default on its monthly payments. The letter was valued between $14 and $16 million dollars. US Bank's cancellation of credit extended to Allrise was made public at last Tuesday's PUD Commissioner's meeting. Our PUD is allowing Allrise some time to find a new, reputable creditor willing to financially backstop Allrise. Providing a performance guarantee letter is similar to co-signing on a loan. US Bank's actions appear to reflect an assessment that Allrise is too risky even for the banking giant. The action follows the collapse of Allrise's bank, Silicon Valley Bank, as part of chain of failures of the leading crypto-servicing banks in the US, followed by Allrise defaulting on its March payment to our PUD. See our previous reporting here: UPDATE: FDIC BAILS OUT SVB DEPOSITORS; ANOTHER CRYPTO BANK COLLAPSES - PROTECT PEND OREILLE And here: Cascade Digital Mining defaults on payment; PUD issues Letter of Default - PROTECT PEND OREILLE Last summer our PUD wisely rejected a performance guarantee from the now-failed Silcon Valley Bank and demanded Allrise obtain a letter of credit guaranteeing payments from a more reputable bank. Ultimately, US Bank agreed to provide the performance guaranteeing letter of credit, which has now been rescinded. Our PUD requires the performance guarantee because Allrise is engaged in a highly risky business and has an unsatisfactory credit history and inadequate finances to cover the value of their power contract with our PUD. The performance guarantee reflects improved risk management practices learned from the bankruptcy of the Ponderay Newsprint Company bankruptcy in 2020. At that time, our PUD did not have adequate risk protection in place, leaving its citizen-owners on the hook for $22 million of the $32 million in financial damages to our PUD from that bankruptcy. They even already employ the former PNC mills bankruptcy attorneys. And the Allrise/Bitmain facility with its myriad of LLCs, including corporations domiciled in the Cayman Islands, was built from the ground up for bankruptcy. While our PUD has granted Allrise time to find a new guarantor, the timing will surely have negative impact on Allrise's/Bitmain's current negotiations for new power contract to take effect in October. Allrise may also struggle to find a suitable bank given their history and the government's recent warnings to banks about the risks from crypto customers.

Beijing Bitmain's and Allrise Capital's bitcoin mining facility in Usk has been in the national news several times in the last couple of weeks-- and not in a good way. Today, Politico reporter Niina Farah writes about how people opposed to the negative environmental, social, and economic consequences of industrial-scale bitcoin mining are banding together.

Ms. Farah wrote: In the wake of a national surge in crypto mining, local activists are searching for ways to fight the energy-intensive industry’s rapid growth — and calling on Congress for backup. Crypto mines — banks of computers that run to obtain digital currency — can operate as much as 24 hours per day, seven days a week and, depending on their energy source, can spew significant levels of planet-warming gases. After China cracked down on crypto mining within its borders a year and a half ago, the industry has become a growing presence in communities with cheap electricity from hydropower — and also from more carbon-intensive sources like natural gas and coal. “These miners are moving to the United States and spreading like cancer across the country,” said Yvonne Taylor, one of the founders of the National Coalition Against Cryptomining, a new advocacy group uniting activists from Georgia to Washington state. She added: “We had to do something on a national level.” In 2020, before China’s crackdown on crypto mining, the United States accounted for just 3.5 percent of global mining of bitcoin, the leading type of cryptocurrency. By 2022, that figure had jumped to 38 percent, and the United States is now home to a third of global crypto mining assets, according to a report from the White House Office of Science and Technology Policy (OSTP). The crypto boom has led to a tripling of energy usage since 2021 — matching the amount of power needed to turn on the lights in every home in the United States. Read her full article, including several paragraphs about the facility in Pend Oreille County here: Crypto foes gird to stop mines from 'spreading like cancer' - E&E News (eenews.net) By Ulrich Bindseil and Jurgen Schaaf

The value of bitcoin peaked at USD 69,000 in November 2021 before falling to USD 17,000 by mid-June 2022. Since then, the value has fluctuated around USD 20,000. For bitcoin proponents, the seeming stabilization signals a breather on the way to new heights. More likely, however, it is an artificially induced last gasp before the road to irrelevance – and this was already foreseeable before FTX went bust and sent the bitcoin price to well below USD16,000. Bitcoin is rarely used for legal transactions Bitcoin was created to overcome the existing monetary and financial system. In 2008, the pseudonymous Satoshi Nakamoto published the concept. Since then, Bitcoin has been marketed as a global decentralised digital currency. However, Bitcoin's conceptual design and technological shortcomings make it questionable as a means of payment: real Bitcoin transactions are cumbersome, slow and expensive. Bitcoin has never been used to any significant extent for legal real-world transactions. In the mid-2010s, the hope that Bitcoin's value would inevitably rise to ever new heights began to dominate the narrative. But Bitcoin is also not suitable as an investment. It does not generate cash flow (like real estate) or dividends (like equities), cannot be used productively (like commodities) or provide social benefits (like gold). The market valuation of Bitcoin is therefore based purely on speculation. Speculative bubbles rely on new money flowing in. Bitcoin has also repeatedly benefited from waves of new investors. The manipulations by individual exchanges or stablecoin providers etc. during the first waves are well documented, but less so the stabilising factors after the supposed bursting of the bubble in spring. Big Bitcoin investors have the strongest incentives to keep the euphoria going. At the end of 2020, isolated companies began to promote Bitcoin at corporate expense. Some venture capital (VC) firms are also still investing heavily. Despite the ongoing "crypto winter", VC investments in the crypto and blockchain industry totalled USD 17.9 billion as of mid-July. Regulation can be misunderstood as approval Large investors also fund lobbyists who push their case with lawmakers and regulators. In the US alone, the number of crypto lobbyists has almost tripled from 115 in 2018 to 320 in 2021. Their names sometimes read like a who's who of US regulators. But lobbying activities need a sounding board to have an impact. Indeed, lawmakers have sometimes facilitated the influx of funds by supporting the supposed merits of Bitcoin and offering regulation that gave the impression that crypto assets are just another asset class. Yet the risks of crypto assets are undisputed among regulators. In July, the Financial Stability Board (FSB) called for crypto assets and markets to be subject to effective regulation and supervision commensurate with the risks they pose - along the doctrine of "same risk, same regulation". However, legislation on crypto-assets has sometimes been slow to ratify in recent years - and implementation often lags behind. Moreover, the different jurisdictions are not proceeding at the same pace and with the same ambition. While the EU has agreed on a comprehensive regulatory package with the Markets in Crypto-Assets Regulation (MICA), Congress and the federal authorities in the US have not yet been able to agree on coherent rules. The current regulation of cryptocurrencies is partly shaped by misconceptions. The belief that space must be given to innovation at all costs stubbornly persists. Since Bitcoin is based on a new technology - DLT / Blockchain - it would have a high transformation potential. Firstly, these technologies have so far created limited value for society - no matter how great the expectations for the future. Secondly, the use of a promising technology is not a sufficient condition for an added value of a product based on it. The supposed sanction of regulation has also tempted the conventional financial industry to make it easier for customers to access bitcoin. This concerns asset managers and payment service providers as well as insurers and banks. The entry of financial institutions suggests to small investors that investments in Bitcoin are sound. It’s also worth noting that the Bitcoin system is an unprecedented polluter. First, it consumes energy on the scale of entire economies. Bitcoin mining is estimated to consume electricity per year comparable to Austria. Second, it produces mountains of hardware waste. One Bitcoin transaction consumes hardware comparable to the hardware of two smartphones. The entire Bitcoin system generates as much e-waste as the entire Netherlands. This inefficiency of the system is not a flaw but a feature. It is one of the peculiarities to guarantee the integrity of the completely decentralized system. Promoting Bitcoin bears a reputational risk for banks Since Bitcoin appears to be neither suitable as a payment system nor as a form of investment, it should be treated as neither in regulatory terms and thus should not be legitimised. Similarly, the financial industry should be wary of the long-term damage of promoting Bitcoin investments - despite short-term profits they could make (even without their skin in the game). The negative impact on customer relations and the reputational damage to the entire industry could be enormous once Bitcoin investors will have made further losses. Note: Mr. Bindseil is the Director General of the European Central Bank. This article was originally published on the ECB Blog at Bitcoin’s last stand (europa.eu) |

|||||||||||||