Harbinger of Insolvency: High prices for market power futures may hasten Bitmain/Allrise bankruptcy6/27/2023 Rising prices for electricity futures on the Mid-Columbia Hub power market may hasten bankruptcy for Beijing’s Bitmain and Allrise Capital’s massive bitcoin mining facility in Usk, WA. At current future’s prices for nine out of the next twelve months, the price of the electricity needed to run their 18,000+ voracious bitcoin-mining computers will be higher than the value of the bitcoin those miners can earn at the current bitcoin price of around $30,000. For the next several months, Bitmain/Allrise may not even bother to turn their machines on. Electricity futures allow utilities and other large customers to lock in a price for electricity at a future date as a way to hedge risk against even higher prices. When the futures date arrives, actual spot prices may be higher or lower, but futures prices therefore represent the consensus expectation of actual future prices by participants in the market. Because Bitmain/Allrise require more than three times more electricity than the rest of Pend Oreille County but together, they have to purchase the bulk of their electricity from the Mid-Columbia Hub (the regional power market). The blue line in the chart below shows the current (as of June 26) futures prices for a megawatt of electricity. The red line shows the current electricity break-even price for Bitmain/Allrise’s bitcoin mining operations in Usk at the currently high price of bitcoin-- $108 per megawatt. This price varies with the price of bitcoin and the number of bitcoin the Usk facility’s miners can earn each day (currently around 6 bitcoin per day). Next April, the break-even point will drop to $54 per megawatt (under current conditions) due to the halving of the number of bitcoin the facility can potentially earn each day. Each month that the blue line is above the red line is a month where the revenue Bitmain/Allrise will not be enough to pay for the electricity to power their machines, let alone the more than a hundred million dollars in other expenses they have yet to pay back.

There are two factors that may somewhat mitigate, but will not stave off, the ominous future. First, about one-third of the Bimain’s machines can continue to operate at power prices roughly $20 to $30 higher than the older-generation computers that make up the bulk of their computing power. Second, they have been able to purchase some electricity at a lower cost (around $60 per megawatt) directly from our PUD during the winter months when our PUD has excess power to sell—but not nearly enough to run the facility at full capacity. In conducting this analysis, we made several assumptions. First that futures prices would reflect actual power prices in the future, but futures prices for each month have actually been increasing as the purchase month grows closer (e.g. the futures prices for power in August is actually much higher now than it was two months ago reflecting a market expectation that August prices will be higher than current future prices. Second, we assumed that price of bitcoin would remain stable at around $30,000. The current price level is elevated above its one-year and one-month average and crypto continues to face increasing challenges. Third, we assumed that the number of bitcoin the Usk facility can earn each day would remain constant. It will likely continue its multi-year trend of declining over time. So, we expect actual conditions to be worse than when assumed, but they could become better. We previously reported that Bitmain/Allrise were facing a financial disaster of their own creation—largely due to gross negligence on their part in failing to conduct reasonable due diligence about the feasibility of their business plans. See POC Cryptonomics - PROTECT PEND OREILLE Today’s data shows that that disaster may be even closer than anticipated.

1 Comment

Beijing's Bitmain and Allrise Capital are again threatening our citizen-owned PUD with litigation. Bitmain/Allrise's made their latest threats in a letter from their attorney, Mr. Andrew Moratzka, in a letter to the PUD dated April 28 after they the bitcoin miners breached their contract with the PUD.

The PUD responded in a public record document: "It's unfortunate that Cascade continues to minimize the importance of the District's contractual protections, and use threats of litigation to coerce the District into capitulating to Cascade's demands. One need look no further than the very recent collapse of Cascade's preferred bank and Letter of Credit issuer-- Silicon Valley Bank-- to understand why the District insists that Cascade's Letter of Credit be issued or confirmed by a Qualified Institution." [Cascade Digital Mining is the LLC joint venture owned by Bitmain and Allrise]. The background of the threats is that Bitmain/Allrise are required to maintain a letter of credit worth $16 million from a financial institution with a top-level credit rating as a part of their current contract with the PUD. The letter or credit protects the PUD citizen-owners from having to pay off money that Bitmain/Allrise owe the PUD in case of the high-risk bitcoin mining venture, which is pre-built for bankruptcy and has been a financial disaster for the two companies thus far, fails and enters bankruptcy. The PUD has been more careful about managing its risk after the former Ponderay Newsprint Company declared bankruptcy in 2020 leaving the PUD's citizen-owners with $22 million in unpaid debts resulting in double-digit rate increases. There are two important points. First, Bitmain/Allrise have been poor corporate citizens demonstrating by their pattern of threatening our PUD almost from the moment they purchased the former PNC mill site. Second, it is important to recognize that these threats are coming from a company partly owned by a Beijing-based corporation that is the primary investor and financial beneficiary of the project. It is simply not right that foreign corporation, especially one controlled by the People's Republic of China, to break its contracts and then coerce small-town America with threats of litigation. Next Monday (June 26), Beijing’s Bitmain and Allrise Capital will announce a new scheme to get our communities and business to subsidize Beijing’s bitcoin mining operation at the former PNC papermill in Usk, WA.

They are calling the scheme the Pend Oreille Innovation Center. According to Mr. Trevor Lane, who is one of the partners, the project will use heated wastewater from Bitmain/Allrise’s nearly 5,000 water-cooled mining computers to heat a small 14x30 greenhouse to grow produce during winter months. It appears that investment in and revenue from the project will be used to offset Bitmain/Allrise’s bitcoin mining costs. This scheme exposes the project’s partners, which include at least one local community, to substantial risks. First, greenhouse agriculture generally requires a lengthy period of time to recoup the initial investment in the building and materials. However, Beijing/Allrise’s financially troubled bitcoin facility is a short-horizon business project even under favorable economic conditions. The mining computers in Usk have limited lifespans and given that the Usk facility is not a competitive crypto mining site due to higher-than-average market power prices in the Pacific Northwest, it is unlikely Bitmain/Allrise will commit the hundreds of millions of dollars to recapitalize their facility in the next couple of years. Second, bitcoin mining is a highly speculative, high-risk enterprise facing ever-growing challenges in finding banks willing to lend to it and a fierce regulatory crackdown. Bitmain/Allrise have made only a tiny fraction of the money they need to make to break even on their initial investment. There is a real risk that any greenhouses will be left out in the cold. Finally, while our state’s climate policy is misguided, partnering with a Bitmain/Allrise, whose bitcoin miners are responsible for over half a million tons of carbon emissions, will cause reputational harm to Bitmain/Allrise’s partners. Yesterday, Gary Gensler, the chairman of the Securities and Exchange Commission (SEC) sat down with the Wall Street Journal to discuss why the SEC is working to reign in crypto. Here are some excerpts of his comments:

"We've seen this story before. It's called the 1920s. The hucksters, the fraudsters, the scam artists, the bankruptcies were preying upon the public's interest in a new form, investing in the stock market after World War I. And it ended with, of course, the Great Depression of the 1929 crash and so forth. And as a bit of a student of financial history, a lot of what we see in crypto has some of these same infirmities. You're not getting the full, fair and truthful disclosure." "I would really contend probably the only successful path forward is to ensure the public gets their proper disclosure and that the platforms in the middle of the market are not so conflicted, so bundled up that they're just there to take money out of the pockets of the investing public. That's what we saw in the 1920s, and look at how many hucksters and fraudsters we've already seen in this field." "You've got platforms against which you're trading. They're both a hedge fund trading against you, they might be borrowing against your assets. They might not even be keeping your assets. We allege in Binance that you may have thought that your funds or crypto were custodied here in the US, and not so clear that they were. We allege in Binance that it had a great amount of deception and concealment about where your funds and crypto were, that they were co-mingling the house funds with your funds. I would suggest you'd want to be very careful. And if somebody's not giving you disclosure, you should ask yourself, why aren't they willing to give me the disclosures I deserve and under the law I'm supposed to get? Why isn't that crypto trading platform properly separating my funds and putting them remote from the bankruptcy?" "The risk is actually that somehow crypto undermines that traditional system of trust, that when you use a brokerage app, you use a robo-advisor or even you pick up the phone and you talk to some humans at a bank or a broker-dealer, you trust in that system. The greater risk is that somehow the crypto field undermines that trust in our traditional system." See the previous report on the recently filed lawsuits against crypto giants Binance and Coinbase here: Biggest Federal Crackdown on Crypto to Date: SEC files lawsuits against two largest crypto exchanges-- threatens another collapse in bitcoin prices - PROTECT PEND OREILLE The complete interview is available here: SEC Chair Gary Gensler on His Crypto Crackdown - The Journal. - WSJ Podcasts Last month local executives for Beijing’s Bitmain and Allrise Capital repeatedly advertised that anthe release of a power feasibility study being conducted by the Bonneville Power Administration (BPA) would enable them to restart the papermill—BUT ONLY IF the residents of Pend Oreille County contribute millions of dollars each year to subsidize the cost of Beijing’s bitcoin mining.

The BPA completed the study on May 24 and Bitmain/Allrise isn’t likely to be very happy with its findings. The study evaluated how much it would cost to provide 70 megawatts of additional power to Bitmain/ Allrise existing 100 MW bitcoin facility using a powerline connecting the Box Canyon Dam to BPA power grid in Mead, WA, with an interconnection stop at former papermill site in Usk. The Bottom Line up Front from the report is adding an additional 70 mw of power will cost around $36 million and take 3-5 years. The study’s finding derails Bitmain/Allrise’s bid to use the papermill restart claim as leverage against the PUD in the current contract negotiations. We asses that this will effectively kill the highly suspect restart claim. Background: Bitmain/Allrise initially requested that the BPA conduct this feasibility study last September, only a few weeks after entering into a 13-month power contract with our PUD. At that time, Bitmain/Allrise executives complained to the PUD that the market price for power was too high for them to operate economically and they demanded that the PUD give them with a new, lower-cost power contract in which power their power costs would be subsidized by county residents. Bitmain/Allrise attempted to use a highly suspect claim that they would re-start the papermill but only if the PUD agreed to the lower, subsidized power rates. Key findings of the report: 1. The cost to BPA for the upgrade is estimated as $26.3 Million. 2. The PUD will need to do substantial additional work which will likely cost around another $10 million. 3. The project would have ongoing annual costs because it would impact Avista as well and the PUD would likely need to compensate Avista for the additional power balancing that would be required to maintain grid reliability. 4. BPA estimated the work to take 3-4 years AFTER all preliminary studies and environmental reviews were completed— work that would likely add at least a year to the project timeline. As we have previously reported, the BPA power study appeared designed to be used as a weapon against the PUD. Bitmain/Allrise-requested BPA study due this week appears designed to pick a fight with PUD - PROTECT PEND OREILLE Most residents of the county are skeptical about Bitmain/Allrise’s claim that they intend to restart the papermill. Their local executives have publicly admitted that the costs of operation have substantially increased since the mill entered bankruptcy in 2020 and would not likely be profitably, even admitting that they hadn’t actually even completed a business plan. Local engineers who have recently inspected the mill machinery have uniformly reported that the equipment has mostly not been maintained and would cost additional millions to refurbish. See: Facts on the Ground show Allrise couldn't open the paper mill within five years if they wanted to (and they probably don't) PROTECT PEND OREILLE - Home Critics question grant request to restart Usk papermill - PROTECT PEND OREILLE On the other hand, Bitmain/Allrise are desperate for lower power prices and appear to be using the claim to restart the papermill simply as leverage against the PUD in contract negotiations. See: PUD Documents Show Allrise/Bitmain Misleading Public about Box Canyon Deal - PROTECT PEND OREILLE Papermill restart likely a bait-and-switch to get Pend Oreille residents to subsidize Beijing's Bitcoin Mining - PROTECT PEND OREILLE We assess the findings of this BPA study will further undermine the legitimacy of Bitmain/Allrise’s suspect claims about the papermill to the point where the papermill restart claim is finally dead. The Newport Rodeo is a shining example of economic development done right in Pend Oreille County. Sadly, the rodeo board and volunteers have had to work for their success without significant support from the county’s tax-payer supporter and scandal-ridden Economic Development Council. The Wall Street Journal recently ran a front-page cover story reporting on the exploding popularity of rodeos as mainstream entertainment across the county. More than any other event or business, our rodeo puts Pend Oreille County on the map. Fortunately, a visionary and competent rodeo board of directors is putting Newport at the forefront of our region in this growing entertainment industry. Our rodeo is already one of the top events in the Professional Rodeo Cowboys Association (PRCA) regional Columbia River Circuit—second of 56—and our exceptional rodeo team is taking us to the next level. This year we will move from a “small” to a “medium” category and the event will be broadcast live across the nation. The rodeo team has responsibly invested in renovating our arena so that it is not only a first-rate rodeo venue for both cowboys and fans, but also a regional event venue that is now able to support concerts, shows, and performances for as many as 6,000 fans traveling to Newport from all around the inland Northwest. And these fans will spend their money at Newport’s businesses over and over again. Inexplicably, both the rodeo and the revenue potential of an upgraded arena have been either ignored or received only the most tepid support from county officials responsible for economic development funds. The county EDC is sitting on over $140,000 in hoarded cash that it could be used to promote real economic development that supports more than six crypto jobs. The Security and Exchange Commission made it's biggest moves against crypto operations to date by filing lawsuits against the world's two largest crypto exchanges-- the Chinese company Binance and the US-based Coinbase. The suits could send bitcoin prices tumbling adding to the continuing woes of Beijing Bitmain's and Allrise Capital's massive Usk bitcoin facility.

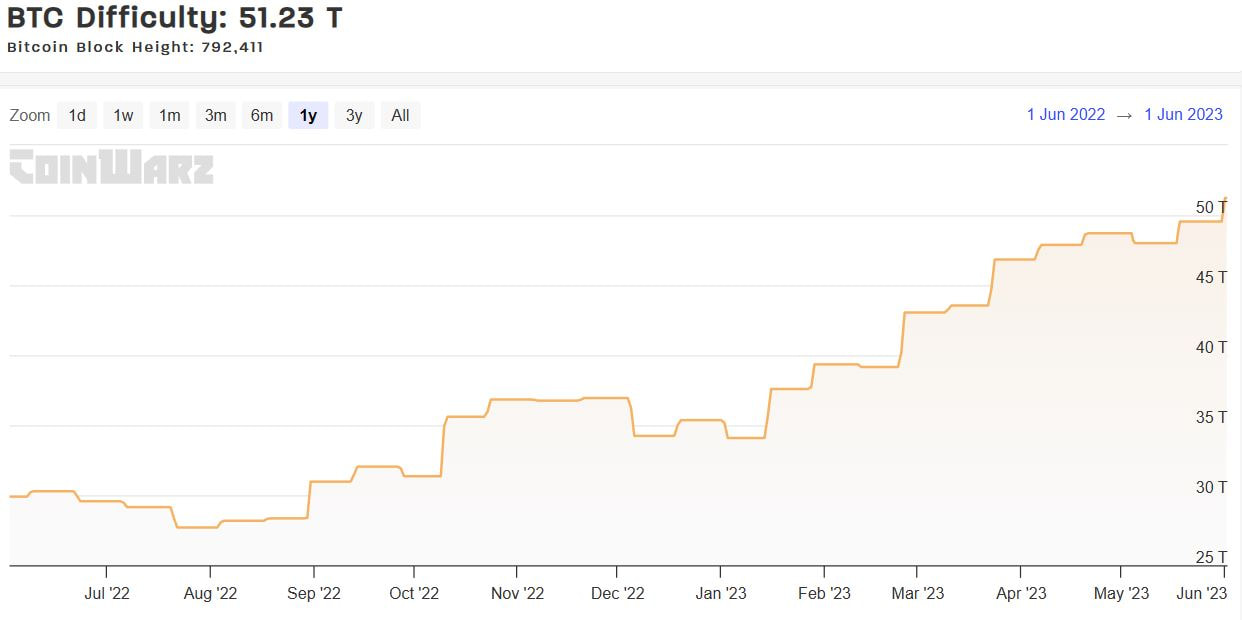

The SEC alleged that Binance, which controls almost half of all crypto transactions and the overwhelming majority of global bitcoin transactions misused customer funds and ran an illegal crypto exchange in the US. Binance had been evading US regulations. According to the Wall Streat Journal, the SEC claims that Binance commingled billions of dollars of customers assets and sent them to another company owned by Binance founder Changpeng Zhao-- an illegal practice that caused the collapse of the third largest crypto exchange FTX last November. The SEC also asked the judge in suit to put Binance's US assets in receivership. The Wall Street Journal previously reported that Binance had secretly and illegally been running its US operations from People's Republic of China. The paper also previously reported that the Department of Justice was considering filing criminal charges against Zhao for money laundering. This morning the SEC filed a second suit against Coinbase, the second largest exchange. The suit against Coinbase is less expansive than the one against Binance. The SEC is alleging that Coinbase has been trading at least 13 types of unregistered securities on its exchange. Bitcoin prices dipped by over $1,000 on the news. Given Binance's and Coinbase's essential roles in the crypto ecosystem, the suits may case bitcoin prices to tumble in the same way FTX's collapse (FTX was previously the third largest global exchange) tanked bitcon prices by 15-20 percent last fall. The SEC may not be done yet with major enforcement actions. The crypto company Tether, which operates a easily convertible stable coin that can be converted to US dollars that is essential to functioning crypto markets, has long been suspected of illegal business practices. SEC action against Tether after suits against Binance and Coinbase could cause irreparable damage to crypto prices. The SEC moves highlight how high the risks are in the crypto industry. Increasing mining difficulty continues to erode Beijing Bitmain's and Allrise Capital's revenue potential from their massive bitcoin mining facility in Usk, WA. Yesterday, bitcoin mining difficulty extended to yet another all-time high. Mining difficulty impacts the number of bitcoin miners are able to earn each day. With yesterday's increase, Bitmain's 18,000 mining computers in Usk can no only earn around 6.1 bitcoin per day compared to around 9 bitcoin per day last September when they began full-scale operations-- a 30 percent drop in bitcoin earning potential in just 9 months! The bitcoin algorithm automatically adjusts mining difficulty every two weeks in order to maintain the rate of global bitcoin production to 900 per day. As more and more miners have joined the bitcoin mining guessing competition, difficulty levels have nearly doubled (180% increase) since September. Source: Bitcoin Difficulty Chart - BTC Difficulty - CoinWarz

To put this change in perspective, under the current bitcoin mining difficulty and price conditions, Bitmain/Allrise would have generated almost no after-power revenue in April 2023. For a more more details on how difficulty levels impact Bitmain's/Allrise's revenue potential see: It's counterintuitive-- Bitcoin prices are edging up, but that's a bad thing for Beijing Bitmain's/Allrise Capital's Usk bitcoin mining facility - PROTECT PEND OREILLE And POC Cryptonomics - PROTECT PEND OREILLE Pend Oreille County has been backing the wrong horse when it comes to economic development.

The county has two alternatives in resourcing an organization to promote economic development: pool its resources with Stevens and Ferry Counties in the Tri County Economic Development District (TEDD) or pay more for less with a local economic development council. Our county commissioners picked the loser. Last week’s announcement in this paper that TEDD had earned a $12 million grant for rural high-speed internet —none of which will go to POC because our commissioners rejected joining TEDD—highlighted the disparity between TEDD’s quantifiable successes and our EDC’s quantifiable failures. In contrast, our EDC has managed to destroy our county’s credibility with the state and potential business partners. The EDC squandered $300,000 in debt the county now owes to the state after failing to recoup a state grant it spent on the failed silicon smelter project even though HiTest Sands/PacWest had clearly breached its contract with the EDC in mid-2020. Then they duplicitously applied for a state grant, allegedly to restart the paper mill, even though the application specified that the money would be used to upgrade the electrical system of the bitcoin mining facility that has taken over the site. The state, unsurprisingly, rejected that grant. In February, the EDC asked the county for more money for a “Clean Energy” committee led by employees and surrogates of Bitmain/Allrise, which the New York Times reported is one of the top ten carbon emitters of crypto miners. Finally, the regional representative from the State Department of Commerce recently told the county commissioners that the state wanted to support regional, multi-county projects, not requests from lone county EDCs. The recent resignation of EDC director provides opportunity to make a better choice and get more for less with TEDD. Learn more about TEDD here: Home Page • Tri County Economic Development District (tricountyedd.com) Last month Bitcoin prices were at their highest point in a year, but those higher prices failed to translate into higher after-power revenue for Beijing's Bitmain and Allrise Captial from their massive bitcoin mining facility at the converted PNC paper mill site in Usk, WA.

Public records obtained from the PUD indicated that Bitmain/Allrise only brought in around an anemic $375,000 in revenue during the month of April after paying their power bill. Given that Bitmain and Allrise collectively spent between $100 and $300 million to set up the largest bitcoin mining facility west of Texas at the Usk site and only have less than a year left to recoup their investment, April's earnings reinforce our analysis that the Beijing's project in Pend Oreille County has been a financial disaster. See Why the Usk Bitcoin Mine is a Financial Disaster for Bitmain and Allrise Capital at POC Cryptonomics - PROTECT PEND OREILLE Last month Bitmain/Allrise paid $5,247,555.56 for 53,280 megawatt hours of electricity. (Note: only a small fraction of that amount actually went to our PUD). In return, Cascade Digital Mining, the joint-venture LLC between Bitmain and Allrise, was able to earn an average of 6.5 bitcoin each day at an average price of $28,833 per bitcoin. That works out to around $5,6222,500 in total BEFORE-POWER-COST revenue. Subtract the cost of power and that leaves only around $375,000 in total AFTER-POWER-COST revenue for the month. That is not enough to ever pay off their sunk costs in the facility before the bitcoin machines fall apart, let alone before the pending bitcoin "Halving" event next April that will double the cost of competing for bitcoin (aka mining). For more on the "Halving" see Only A Year Away From Disaster: Beijing’s Bitmain and Allrise Capital’s Usk Bitcoin mine faces financial collapse next spring unless bitcoin prices explode - PROTECT PEND OREILLE Even though bitcoin prices were at an annual high, mining revenue still declined for two reasons. FIrst, the number of bitcoin the Usk facility can potentially earn each day has fallen by 30 percent since they began full-scale operations last September as more and more bitcoin miners are competing for a fixed number of bitcoin available each day. See It's counterintuitive-- Bitcoin prices are edging up, but that's a bad thing for Beijing Bitmain's/Allrise Capital's Usk bitcoin mining facility - PROTECT PEND OREILLE Second, the price of market power must purchase most months of the year has remained stubbornly high. In April they paid an all-in price of $98.50 per megawatt hour, or 9.85 cents per kilowatt hour. More competitive industrial-scale miners in other parts of the country typically pay closer to 3 cents per kilowatt hour for their power. The higher market prices help explain why Beijing's Bitmain and Allrise Capital continue to be so aggressive in pressuring our PUD to make its other 9,600 customers subsidize their power costs. |