Why the Usk Bitcoin Mine is a Financial Disaster for Bitmain and Allrise Capital

Beijing’s Bitmain’s Bitcoin mining joint venture with Allrise Capital (aka Merkle Standard) at the former Ponderay Newsprint mill site in Usk has been a financial disaster. This article will lay out the numbers and review the very limited number of remedies available (other than winning the lottery, wishing on a star, or finding a leprechaun’s pot of gold).

We will answer two key questions:

1) How much can Bitmain/Allrise’s Usk Bitcoin mining facility make?

2) How much does Bitmain/Allrise’s Usk Bitcoin mining facility need to make?

BLUF: For those who might want to skip the more detailed analysis below, here is the Bottom Line Up Front:

1) 86% drop in mining profitability since fall 2021. Due to lower Bitcoin prices, higher electricity prices, and an explosion in the number of miners competing to earn Bitcoin, mining profitability has collapsed 86% since Allrise and Bitmain partnered together in fall 2021.

2) The Usk Crypto Mill is not competitive compared to all other large-scale bitcoin miners.

3) Bitmain and Allrise need to make $100-300 Million just to recoup their initial capital investment in Usk and they have only one year left to do it because the cost of producing Bitcoin will double next March.

4) The Usk facility has likely generated less than $10 million (probably closer to $5 million) in after-power-costs revenue since beginning operations last summer/fall.

5) The maximum revenue potential of the Usk facility over the next year is $27.6 Million and that is only under fantasy-level conditions of:

CONCLUSIONS:

1) Under realistic conditions, Bitmain’s and Allrise’s Usk facility will NEVER generate enough revenue to recoup the initial investment.

2) Bitmain and Allrise could generate 3x more revenue by closing the Usk facility and moving their Bitcoin mining computers to their existing South Carolina facility.

We will answer two key questions:

1) How much can Bitmain/Allrise’s Usk Bitcoin mining facility make?

2) How much does Bitmain/Allrise’s Usk Bitcoin mining facility need to make?

BLUF: For those who might want to skip the more detailed analysis below, here is the Bottom Line Up Front:

1) 86% drop in mining profitability since fall 2021. Due to lower Bitcoin prices, higher electricity prices, and an explosion in the number of miners competing to earn Bitcoin, mining profitability has collapsed 86% since Allrise and Bitmain partnered together in fall 2021.

2) The Usk Crypto Mill is not competitive compared to all other large-scale bitcoin miners.

3) Bitmain and Allrise need to make $100-300 Million just to recoup their initial capital investment in Usk and they have only one year left to do it because the cost of producing Bitcoin will double next March.

4) The Usk facility has likely generated less than $10 million (probably closer to $5 million) in after-power-costs revenue since beginning operations last summer/fall.

5) The maximum revenue potential of the Usk facility over the next year is $27.6 Million and that is only under fantasy-level conditions of:

- Bitcoin prices stay at the highest price they have reached since opening (20% higher than the average price during that period)

- They can purchase power at the lowest monthly power prices they have had to date (which is less than half the average power price during that period)

- No more Bitcoin miner join the competition to win Bitcoin (Large mining companies are still carrying out massive expansions)

CONCLUSIONS:

1) Under realistic conditions, Bitmain’s and Allrise’s Usk facility will NEVER generate enough revenue to recoup the initial investment.

2) Bitmain and Allrise could generate 3x more revenue by closing the Usk facility and moving their Bitcoin mining computers to their existing South Carolina facility.

From Gold Mine to Money Pit: What Happened?

To understand the magnitude of the disaster, we first need to understand what Bitmain and Allrise expected from the paper mill turned crypto mine. In the fall of 2021, Allrise Capital persuaded (although tricked might be a better word) the Beijing-based Bitcoin mining giant, Bitmain, to form a joint venture called Cascade Digital Mining (CDM). Allrise would provide the site, which they erroneously believed would support 600 megawatts of inexpensive, hydro-generated electricity—enough to build the largest Bitcoin mining facility in the world at that time. Bitmain would provide hundreds of millions of dollars of bitcoin mining computers.

Bitmain and Allrise planned to quickly install 30,000 mining computers. These machines would be able to make 3.75 quintillion guesses each second. This represented 2.3% of the total global bitcoin mining capability at the time and would have produced an average of 21 Bitcoin per day. Bitcoin prices were at their all-time high of $69,000 and experts expected the price to continue climbing to at least $100,000 per Bitcoin in 2022. Allrise also promised Bitmain inexpensive power prices around 2-3 cents per kilowatt hour—a rate on par with what other large industrial Bitcoin mining companies were paying.

Under those conditions Allrise and Bitmain could have reasonably expected to make $500 to $750 million during their first year alone. Future expansion would have brought even higher profits.

But things quickly started to go wrong. First, Allrise’s local employees failed to inquire if county zoning laws would allow for an industrial mining facility on a property zoned for residential use. The laws didn’t, had the start of mill was delayed for months while Allrise/Bitmain applied for a conditional use permit. Then in April 2022, Bitmain discovered that Allrise had failed to conduct any due diligence regarding the actual capabilities of the power infrastructure supporting the former mill site. Expanding beyond the site beyond 100 megawatts would be impractical.

The following month (May), Allrise//Bitmain’s proposed electricity provider, Brookfield Renewable, walked away from negotiations after spending several weeks conducting a due-diligence review of Allrise and Bitmain, delaying the start of large-scale Bitcoin mining until September 2022 after reaching electrical service agreement with our PUD. By this time, Bitmain and Allrise had installed almost 18,000 mining computers at Usk with another 12,000 on their way. But Bitmain was growing impatient, and these 12,000 machines were diverted from Usk to a gravel strip next to a powerline in Spartanburg, South Carolina, where they would be able to generate 3x more revenue than they could in Usk (due to cheaper power prices).

Over that time Bitcoin mining profitability collapsed by 86% as Bitcoin shed two-thirds of its artificially inflated bubble value and market power prices were soared due to seasonal weather extremes mixed with the effects of new state and national energy policies.

The chart below shows the change in mining profitability over the last three years. The red lines marks profitability at the time Bitmain partnered with Allrise Capital to establish their facility in Usk.

Bitmain and Allrise planned to quickly install 30,000 mining computers. These machines would be able to make 3.75 quintillion guesses each second. This represented 2.3% of the total global bitcoin mining capability at the time and would have produced an average of 21 Bitcoin per day. Bitcoin prices were at their all-time high of $69,000 and experts expected the price to continue climbing to at least $100,000 per Bitcoin in 2022. Allrise also promised Bitmain inexpensive power prices around 2-3 cents per kilowatt hour—a rate on par with what other large industrial Bitcoin mining companies were paying.

Under those conditions Allrise and Bitmain could have reasonably expected to make $500 to $750 million during their first year alone. Future expansion would have brought even higher profits.

But things quickly started to go wrong. First, Allrise’s local employees failed to inquire if county zoning laws would allow for an industrial mining facility on a property zoned for residential use. The laws didn’t, had the start of mill was delayed for months while Allrise/Bitmain applied for a conditional use permit. Then in April 2022, Bitmain discovered that Allrise had failed to conduct any due diligence regarding the actual capabilities of the power infrastructure supporting the former mill site. Expanding beyond the site beyond 100 megawatts would be impractical.

The following month (May), Allrise//Bitmain’s proposed electricity provider, Brookfield Renewable, walked away from negotiations after spending several weeks conducting a due-diligence review of Allrise and Bitmain, delaying the start of large-scale Bitcoin mining until September 2022 after reaching electrical service agreement with our PUD. By this time, Bitmain and Allrise had installed almost 18,000 mining computers at Usk with another 12,000 on their way. But Bitmain was growing impatient, and these 12,000 machines were diverted from Usk to a gravel strip next to a powerline in Spartanburg, South Carolina, where they would be able to generate 3x more revenue than they could in Usk (due to cheaper power prices).

Over that time Bitcoin mining profitability collapsed by 86% as Bitcoin shed two-thirds of its artificially inflated bubble value and market power prices were soared due to seasonal weather extremes mixed with the effects of new state and national energy policies.

The chart below shows the change in mining profitability over the last three years. The red lines marks profitability at the time Bitmain partnered with Allrise Capital to establish their facility in Usk.

SOURCE: Bitcoin Mining Profitability Chart (bitinfocharts.com)

Largely due to Allrise’s failure to conduct basic due diligence on a number of fronts, Bitmain and Allrise had missed their moment.

NOTE: Bitmain and Allrise Capital have created a jointly governed LLC called Cascade Digital Mining (CDM) which is the corporate embodiment of their joint venture.

Largely due to Allrise’s failure to conduct basic due diligence on a number of fronts, Bitmain and Allrise had missed their moment.

NOTE: Bitmain and Allrise Capital have created a jointly governed LLC called Cascade Digital Mining (CDM) which is the corporate embodiment of their joint venture.

So how much can Cascade Digital Mining maker from Bitcoin Mining in Usk?

Bitcoin mining profitability depends on three factors:

1) The price of Bitcoin

2) The cost of electricity

3) The total number of miners competing to earn Bitcoin

The Price of Bitcoin

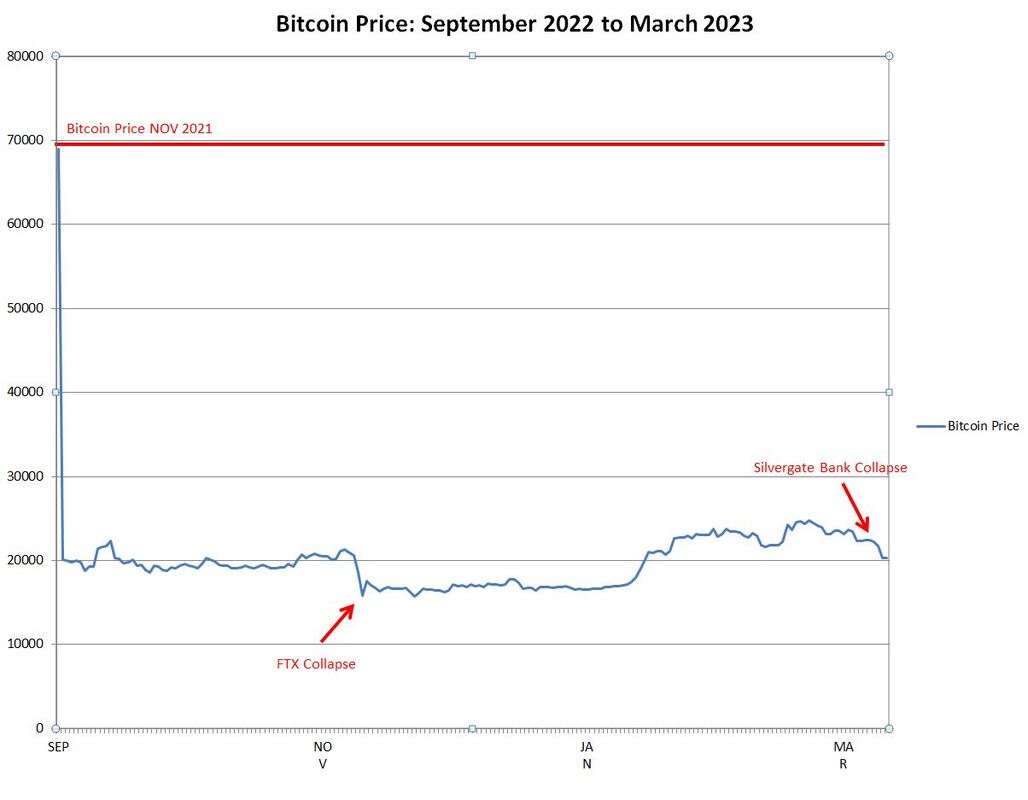

At the time of this writing (March 12), the price of a Bitcoin was around $22,000. Since the CDM’s Usk facility reached its full operational capability in September 2022, the price of Bitcoin has ranged between $15,000 and $25,000.

The chart below shows the change in the daily price of Bitcoin from September 2022 to the present. The red line shows the price of Bitcoin at the time Bitmain and Allrise partnered together to establish the Usk Bitcoin Mining facility.

1) The price of Bitcoin

2) The cost of electricity

3) The total number of miners competing to earn Bitcoin

The Price of Bitcoin

At the time of this writing (March 12), the price of a Bitcoin was around $22,000. Since the CDM’s Usk facility reached its full operational capability in September 2022, the price of Bitcoin has ranged between $15,000 and $25,000.

The chart below shows the change in the daily price of Bitcoin from September 2022 to the present. The red line shows the price of Bitcoin at the time Bitmain and Allrise partnered together to establish the Usk Bitcoin Mining facility.

The Price of Electricity

Competitive industrial Bitcoin miners pay 2-3 cents per kilowatt hour (kwh) for their power. Because CDM’s power requirements are 3x larger than the rest of the county combined, our PUD does not have enough electricity to meet CDM’s needs with its own resources. Although our PUD will, in effect, sell CDM any excess power it does have, the simple reality is that CDM must purchase the majority of the power it requires from the Mid-Columbia electricity market. The average market price since September 22 has been around 14 cents per kwh ($140 per mwh). By excluding price highs above $200 per mwh, the average drops to $119 per mwh (11.9 cents per kwh).

The price of electricity at which Bitcoin mining computers can generate revenue (i.e., more money than the cost of the electricity to run the computer) depends on the efficiency of the mining computer. Bitmain introduces a new generation of Bitcoin mining computers about every 18 months. Each new generation is roughly 30 percent more efficient (i.e., it consumes 30 percent less electricity to compute the same number of guesses). The most efficient computer miners that Bitmain produced in 2019 through mid-2020 (three generations ago) are already obsolete because the cost of electricity to run them is more than the value of the Bitcoin they can potentially win. Only one-third of the computer miners installed in Usk are current-generation machines. The rest are a generation older and require 30 percent more power.

The chart below shows the daily average market price of electricity on the Mid-Columbia Hub since CDM signed its current electrical service agreement with our PUD.

Competitive industrial Bitcoin miners pay 2-3 cents per kilowatt hour (kwh) for their power. Because CDM’s power requirements are 3x larger than the rest of the county combined, our PUD does not have enough electricity to meet CDM’s needs with its own resources. Although our PUD will, in effect, sell CDM any excess power it does have, the simple reality is that CDM must purchase the majority of the power it requires from the Mid-Columbia electricity market. The average market price since September 22 has been around 14 cents per kwh ($140 per mwh). By excluding price highs above $200 per mwh, the average drops to $119 per mwh (11.9 cents per kwh).

The price of electricity at which Bitcoin mining computers can generate revenue (i.e., more money than the cost of the electricity to run the computer) depends on the efficiency of the mining computer. Bitmain introduces a new generation of Bitcoin mining computers about every 18 months. Each new generation is roughly 30 percent more efficient (i.e., it consumes 30 percent less electricity to compute the same number of guesses). The most efficient computer miners that Bitmain produced in 2019 through mid-2020 (three generations ago) are already obsolete because the cost of electricity to run them is more than the value of the Bitcoin they can potentially win. Only one-third of the computer miners installed in Usk are current-generation machines. The rest are a generation older and require 30 percent more power.

The chart below shows the daily average market price of electricity on the Mid-Columbia Hub since CDM signed its current electrical service agreement with our PUD.

- The green line shows the adjusted average power price.

- The red lines show the price points at different Bitcoin prices at which two-thirds of the bitcoin mining computers will need to be shut down because the cost of electricity to run the machines is more than the expected value of the Bitcoin the machines could potentially earn.

- The blue line shows the PUD’s cost per mwh to produce electricity from Box Canyon Dam for reference.

SOURCE: U.S. Energy Information Administration - EIA - Independent Statistics and Analysis

This chart shows that average power prices have been too high for CDM to operate profitably and have often been too high for CDM to operate at all.

The Total Number of Miners

Bitcoin mining is essentially a guessing-game competition in which miners compete against each other to be the first to correctly guess a 64-digit code. The sole function of the mining computers and over 99.9% of the electricity consumed is to generate quintillions of guesses each second. Each competition is designed to take an average of 10 minutes. Miners currently receive a fixed reward of 6.25 Bitcoin for each competition that they win (called a block reward).

A miner’s chance of winning a competition is simply the number of guesses the miner’s own computers can make (this is called the Hash rate) divided by the total number of guesses being made each second by all the other miners in the world. In November 2021, Bitmain’s and Allrise’s initial 30,000 machines would have been able to compute 2.34% of the total number of guesses being made in the world. Since an average of 900 new Bitcoin are awarded each day, they could have expected to earn .0234 x 900 = 21 Bitcoin each day.

As new miners join the Bitcoin guessing competition and the number of guesses being made each second (i.e., the hash rate) increases, the probability of any individual mining computer winning the competition decreases. There are two reasons for this.

First, the Bitcoin algorithm is designed to maintain a constant rate of new Bitcoin awarded each day. In order to keep this number around 900, the algorithm adjusts the difficulty of the competition by changing the total number of guesses needed to win each competition.

The chart below shows the increase in mining difficulty since the Allrise/Bitmain partnership in fall 2021.

This chart shows that average power prices have been too high for CDM to operate profitably and have often been too high for CDM to operate at all.

The Total Number of Miners

Bitcoin mining is essentially a guessing-game competition in which miners compete against each other to be the first to correctly guess a 64-digit code. The sole function of the mining computers and over 99.9% of the electricity consumed is to generate quintillions of guesses each second. Each competition is designed to take an average of 10 minutes. Miners currently receive a fixed reward of 6.25 Bitcoin for each competition that they win (called a block reward).

A miner’s chance of winning a competition is simply the number of guesses the miner’s own computers can make (this is called the Hash rate) divided by the total number of guesses being made each second by all the other miners in the world. In November 2021, Bitmain’s and Allrise’s initial 30,000 machines would have been able to compute 2.34% of the total number of guesses being made in the world. Since an average of 900 new Bitcoin are awarded each day, they could have expected to earn .0234 x 900 = 21 Bitcoin each day.

As new miners join the Bitcoin guessing competition and the number of guesses being made each second (i.e., the hash rate) increases, the probability of any individual mining computer winning the competition decreases. There are two reasons for this.

First, the Bitcoin algorithm is designed to maintain a constant rate of new Bitcoin awarded each day. In order to keep this number around 900, the algorithm adjusts the difficulty of the competition by changing the total number of guesses needed to win each competition.

The chart below shows the increase in mining difficulty since the Allrise/Bitmain partnership in fall 2021.

SOURCE: Bitcoin Difficulty Chart - BTC Difficulty - CoinWarz

Second, the more miners competing, the less likely any one miner will win each competition.

The chart below shows the increase in the hash rate (i.e., the number of miners competing) since the Allrise/Bitmain partnership in fall 2021.

Second, the more miners competing, the less likely any one miner will win each competition.

The chart below shows the increase in the hash rate (i.e., the number of miners competing) since the Allrise/Bitmain partnership in fall 2021.

SOURCE: Bitcoin Hashrate Chart - BTC Hashrate 361.55 EH/s - CoinWarz

These charts show that Bitcoin mining is a digital money pit. Since the amount of new Bitcoin awarded each day is designed to remain constant, the effect of these factors is that miners have to add either additional computers or more powerful computers to their facilities in order to win the same amount of Bitcoin. If they fail to add more guessing power, the number of Bitcoin a miner can earn decreases over time.

For example, in fall 2021 the 18,000 machines currently installed in Usk would have won an average of 14 Bitcoin per day. Nine months later In September 2022 when the Usk facility reached its full operational capability, that number had dropped to 9 Bitcoin per day. As of March 12, 2023, that number has declined even further to 7 Bitcoin per day.

That number will likely continue to decline at least through the end of the second quarter 2023. The reason for this mutual assured destruction among Bitcoin miners is that fall 2021 at the peak of the Bitcoin bubble large private and public Bitcoin miners like Riot Blockchain and Northern Data placed orders for hundreds of thousands of the latest generation of Bitcoin mining computers. All of the machines for those orders began arriving for installation last fall and will continue to be installed through the end of Q2 adding to the global guess-rate (hash rate). Because these large industrial miners have already sunk the cost of the machines, often in debt, they will operate them at a loss in order to generate revenue to reduce the magnitude of their losses in the hope that conditions affecting profitability will change in the future. They are chained by their debt to a sinking ship with few options other than to double down on their bets and hope the dice roll a seven.

Counterintuitively, an increase in the price of Bitcoin will not necessarily make the Usk facility more profitable. There are currently a large number of Bitcoin mining computers installed but not currently operating—estimated to be more than 100,000 additional machines—that can will be turned should the price of Bitcoin rise. For example, when Bitcoin recently hit a high of over $25,000, the number of machines in operation (represented by the global hash rate) jumped by over 20 percent. This temporarily reduced the Usk facilities daily potential winnings to 5.3 Bitcoin per day. Had the price of Bitcoin (and the number of mining computes able to generate revenue above the cost of electricity) not declined shortly thereafter,

How Much Can CDM Make?

So how much money can the Usk facility generate? If we assume that magically the price of Bitcoin is able to stay constant at its highest prices since September, and that Bitmain/Allrise is able to get enough electricity to power all of its machines at the lowest power price they have paid since September, and if no more miners join the Bitcoin guessing competition, then the Usk facility could generate a maximum of $27.6 Million in after-power revenue over the next 12 months.

The odds are that it will be a much lower number.

These charts show that Bitcoin mining is a digital money pit. Since the amount of new Bitcoin awarded each day is designed to remain constant, the effect of these factors is that miners have to add either additional computers or more powerful computers to their facilities in order to win the same amount of Bitcoin. If they fail to add more guessing power, the number of Bitcoin a miner can earn decreases over time.

For example, in fall 2021 the 18,000 machines currently installed in Usk would have won an average of 14 Bitcoin per day. Nine months later In September 2022 when the Usk facility reached its full operational capability, that number had dropped to 9 Bitcoin per day. As of March 12, 2023, that number has declined even further to 7 Bitcoin per day.

That number will likely continue to decline at least through the end of the second quarter 2023. The reason for this mutual assured destruction among Bitcoin miners is that fall 2021 at the peak of the Bitcoin bubble large private and public Bitcoin miners like Riot Blockchain and Northern Data placed orders for hundreds of thousands of the latest generation of Bitcoin mining computers. All of the machines for those orders began arriving for installation last fall and will continue to be installed through the end of Q2 adding to the global guess-rate (hash rate). Because these large industrial miners have already sunk the cost of the machines, often in debt, they will operate them at a loss in order to generate revenue to reduce the magnitude of their losses in the hope that conditions affecting profitability will change in the future. They are chained by their debt to a sinking ship with few options other than to double down on their bets and hope the dice roll a seven.

Counterintuitively, an increase in the price of Bitcoin will not necessarily make the Usk facility more profitable. There are currently a large number of Bitcoin mining computers installed but not currently operating—estimated to be more than 100,000 additional machines—that can will be turned should the price of Bitcoin rise. For example, when Bitcoin recently hit a high of over $25,000, the number of machines in operation (represented by the global hash rate) jumped by over 20 percent. This temporarily reduced the Usk facilities daily potential winnings to 5.3 Bitcoin per day. Had the price of Bitcoin (and the number of mining computes able to generate revenue above the cost of electricity) not declined shortly thereafter,

How Much Can CDM Make?

So how much money can the Usk facility generate? If we assume that magically the price of Bitcoin is able to stay constant at its highest prices since September, and that Bitmain/Allrise is able to get enough electricity to power all of its machines at the lowest power price they have paid since September, and if no more miners join the Bitcoin guessing competition, then the Usk facility could generate a maximum of $27.6 Million in after-power revenue over the next 12 months.

The odds are that it will be a much lower number.

How much does CDM's Usk Bitcoin mining facility need to make?

First, we need to determine how much Bitmain and Allrise spent to establish their Bitcoin mining facility in Usk. Second, we need to determine how quickly the Bitmain and Allrise need to recoup the cost of the initial capital investment.

The overwhelmingly largest capital expense is the cost of the Bitcoin mining computers themselves. At the time that Bitmain and Allrise announced their joint venture, the market value of the 18,000 computers, “modular data center” shipping containers, and the specialized electrical equipment was around $230 Million. According to Bitmain’s website, machines delivered to the United States incurred a 27.6% import tariff, which would add an additional $63 Million to the tab. This sets the high-end value of the initial investment capital at around $300 million.

It was not unusual for Bitmain to provide discounted pricing for bulk purchases, so the contract amount may be smaller. Margins on manufacturing bitcoin mining computers are not particularly large and several makers have closed down over the last year. Furthermore, Bitmain and Allrise consummated their partnership at the peak of the Bitcoin bubble when there was enormous demand for Bitmain’s mining computers. This may have limited the size of the discount Bitmain was willing to write into the contract.

However, the collapse of crypto bubble forced many miners to sell their new mining machines on the secondhand market driving the demand and prices for new machines down. Bitmain was forced to reimburse many of its largest customers up to 30 percent of previously made purchases on older-generation machines. Today, the market price for the machines installed at Usk has dropped by about 50 percent. Allrise representatives have described their partnership with Bitmain as a hundred-million-dollar joint venture. This sets the low end of the value of the initial capital investment between $100 and $150 million.

So when do Bitmain and Allrise need to make their money back buy?

Soon. Bitcoin mining is short-time-horizon business. There are three factors at play in the timing here.

The first, and most consequential factor, is the pending reduction in the number of Bitcoin awarded to the winner of each guessing competition from 6.25 to 3.125. This event, called “the Halving” because the block reward is cut in half, happens roughly every four years. The next “Halving” will take place a year from now in March 2024 (give or take a few weeks).

Reducing the number of Bitcoin miners receive for winning each competition effectively doubles the amount of electricity required. To maintain an equivalent level of revenue, either the price of Bitcoin would need to more than double over the next year (unlikely) or the number of miners competing will need to decrease by half (or some combination of both).

This means only the most miners with both the most energy efficient guessing computers and the lowest electricity costs will be able to stay in business. And the Usk facility has neither.

The “Halving” limits the time window available to Bitmain and Allrise to recoup their initial investment to one year from now.

Second, Bitcoin mining computers have a limited useful lifespan. The main problem is not that they wear out quickly (which they do), it is that they become obsolete very quickly. The most efficient mining machines produced through the first half of 2020 (two generations ago) use twice as much electricity to compute the same number of guesses as the most current generation of mining machines. At current Bitcoin prices, the electricity to run the computer costs more than the value of the Bitcoin they could win.

Two-thirds of the computational guessing power at the Usk facility comes from 12,000 machines that are already a generation old and require 30 percent more electricity even though they were only manufactured in 2021. In the race for Bitcoin every day forward leaves these machines farther and farther behind.

Third, there are the provisions of the contract between Bitmain and Allrise. Persons familiar with the details of the contract between Bitmain and Allrise have reported the following:

However, the realized earnings of the facility of fallen significantly short of the maximum potential earnings. First, since the facility went into full operation last September, power prices have been several times higher than the rates Allrise promised to Bitmain. Second, because power prices have been so high, the facility has rarely been able to operate more than a fraction of its guessing computers at one time (with only a couple of months as exceptions).

It is reasonable to assume that Bitmain included a minimum floor for the amount of reimbursement they would receive as a hedge against a downturn in the crypto market. The problem for Bitmain is that based on costs of electricity, the price of Bitcoin, and the average global hash rate, it is unlikely that Bitmain/Allrise facility at Usk has generated more than $5 million in after-power-cost revenue since opening last September (and that is a generous estimate). That leaves them only a year to make back their money.

The overwhelmingly largest capital expense is the cost of the Bitcoin mining computers themselves. At the time that Bitmain and Allrise announced their joint venture, the market value of the 18,000 computers, “modular data center” shipping containers, and the specialized electrical equipment was around $230 Million. According to Bitmain’s website, machines delivered to the United States incurred a 27.6% import tariff, which would add an additional $63 Million to the tab. This sets the high-end value of the initial investment capital at around $300 million.

It was not unusual for Bitmain to provide discounted pricing for bulk purchases, so the contract amount may be smaller. Margins on manufacturing bitcoin mining computers are not particularly large and several makers have closed down over the last year. Furthermore, Bitmain and Allrise consummated their partnership at the peak of the Bitcoin bubble when there was enormous demand for Bitmain’s mining computers. This may have limited the size of the discount Bitmain was willing to write into the contract.

However, the collapse of crypto bubble forced many miners to sell their new mining machines on the secondhand market driving the demand and prices for new machines down. Bitmain was forced to reimburse many of its largest customers up to 30 percent of previously made purchases on older-generation machines. Today, the market price for the machines installed at Usk has dropped by about 50 percent. Allrise representatives have described their partnership with Bitmain as a hundred-million-dollar joint venture. This sets the low end of the value of the initial capital investment between $100 and $150 million.

So when do Bitmain and Allrise need to make their money back buy?

Soon. Bitcoin mining is short-time-horizon business. There are three factors at play in the timing here.

The first, and most consequential factor, is the pending reduction in the number of Bitcoin awarded to the winner of each guessing competition from 6.25 to 3.125. This event, called “the Halving” because the block reward is cut in half, happens roughly every four years. The next “Halving” will take place a year from now in March 2024 (give or take a few weeks).

Reducing the number of Bitcoin miners receive for winning each competition effectively doubles the amount of electricity required. To maintain an equivalent level of revenue, either the price of Bitcoin would need to more than double over the next year (unlikely) or the number of miners competing will need to decrease by half (or some combination of both).

This means only the most miners with both the most energy efficient guessing computers and the lowest electricity costs will be able to stay in business. And the Usk facility has neither.

The “Halving” limits the time window available to Bitmain and Allrise to recoup their initial investment to one year from now.

Second, Bitcoin mining computers have a limited useful lifespan. The main problem is not that they wear out quickly (which they do), it is that they become obsolete very quickly. The most efficient mining machines produced through the first half of 2020 (two generations ago) use twice as much electricity to compute the same number of guesses as the most current generation of mining machines. At current Bitcoin prices, the electricity to run the computer costs more than the value of the Bitcoin they could win.

Two-thirds of the computational guessing power at the Usk facility comes from 12,000 machines that are already a generation old and require 30 percent more electricity even though they were only manufactured in 2021. In the race for Bitcoin every day forward leaves these machines farther and farther behind.

Third, there are the provisions of the contract between Bitmain and Allrise. Persons familiar with the details of the contract between Bitmain and Allrise have reported the following:

- That Bitmain, as the manufacturer of the mining computers, covered the entire initial cost of the miners.

- That revenue from the first year of Bitcoin mining would be used to reimburse Bitmain for the cost of the mining computers.

- That the amount of money due Bitmain would be adjusted according to the maximum earning potential of the facility as determined by the Global hash rate.

However, the realized earnings of the facility of fallen significantly short of the maximum potential earnings. First, since the facility went into full operation last September, power prices have been several times higher than the rates Allrise promised to Bitmain. Second, because power prices have been so high, the facility has rarely been able to operate more than a fraction of its guessing computers at one time (with only a couple of months as exceptions).

It is reasonable to assume that Bitmain included a minimum floor for the amount of reimbursement they would receive as a hedge against a downturn in the crypto market. The problem for Bitmain is that based on costs of electricity, the price of Bitcoin, and the average global hash rate, it is unlikely that Bitmain/Allrise facility at Usk has generated more than $5 million in after-power-cost revenue since opening last September (and that is a generous estimate). That leaves them only a year to make back their money.

CONCLUSIONS

- The Bitcoin system is self-adjusting to a level where only the most efficient miners can operate profitability.

- The cost of mining will increase, decreasing profitability even further.

- Because of its higher power prices combined with a high proportion of older generation machines, Usk is not a competitive facility.

- The problem will grow worse at the halving.

- Can generate revenue that will reduce financial loss but cannot operate profitability.

- Or can choose to relocate machines to more profitable area (like South Carolina).

- Reduction in energy prices limited by the nature of our PUD.

What remedies are open to Bitmain and Allrise?

1) Local Allrise employees (i.e., Merkle Standard) appear determined to try and preserve their jobs here. Ever since they signed their contract with our PUD they have been conducting a campaign to weasel down their electricity costs by persuading our PUD to abandon fundamental risk management processes and to transfer Beijing's Bitcoin mining costs to our PUD's other ratepayers. Their recent red-herring proposals to restart the paper mill (conditional on the PUD providing them with substantially lower power prices) and efforts to nullify the PUD's lucrative contracts to sell the output of the Box Canyon Dam to the Clark County PUD in Vancouver, WA, (which would force to the PUD to sell the power to them at a discount) are parts of that campaign. They hope that lower power prices and an unlikely explosion in the price of Bitcoin will at least reduce the amount of money they lose and maybe even keep them in business a little longer. However, a little math shows that even if successful, these measures would not make the facility profitable. They hope their corporate bosses in Beijing don't pick the next option.

2) Bitmain and Allrise could move their Bitcoin mining machines to new locations where they could generate more revenue-- although there are few locations left where Bitcoin miners can operate profitably. Especially this late in the game.